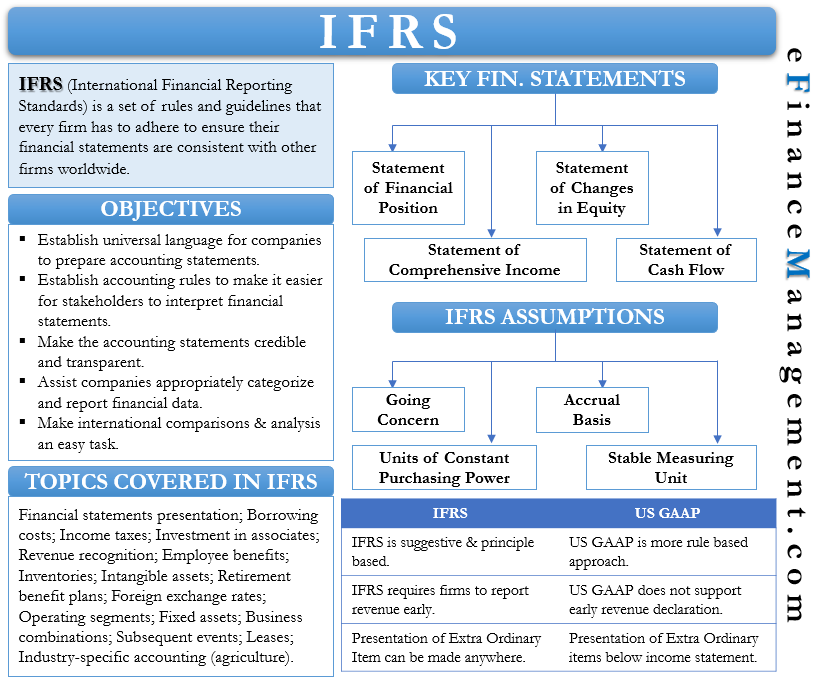

Definition Of Equity Under Ifrs

Structure of Equity differs. Share capital issued by an entity meets the definition of an equity instrument as defined in IAS 32 Financial Instruments when the contract evidences a residual interest in the assets of an entity after deducting all of its liabilities.

Ifrs 11 Joint Arrangements Summary Youtube

Ifrs 11 Joint Arrangements Summary Youtube

A financial instrument is also classified as financial liability if it will or may be settled in a variable number of the entitys own equity instruments.

Definition of equity under ifrs. Equity is defined as any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities IAS 3211. Under IFRS for SMEs either the cost method or equity method may be used by an investor to account for an investment in another entity called an associate in IFRS for SMEs over which the investor has significant influence. The carrying amount is then increased or decreased to recognise the investors share of the subsequent profit or loss of the investee and to include that share of the investees profit or loss in the investors profit or loss.

Issued share capital retained earnings and other components of equity. A According to companys legal form b According to companys policy. GAAP only the equity method may be used THIS SET IS OFTEN IN FOLDERS WITH.

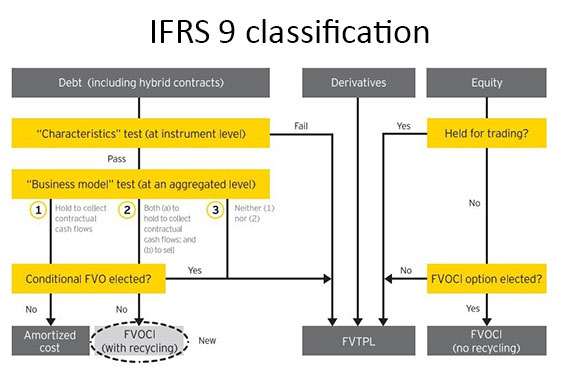

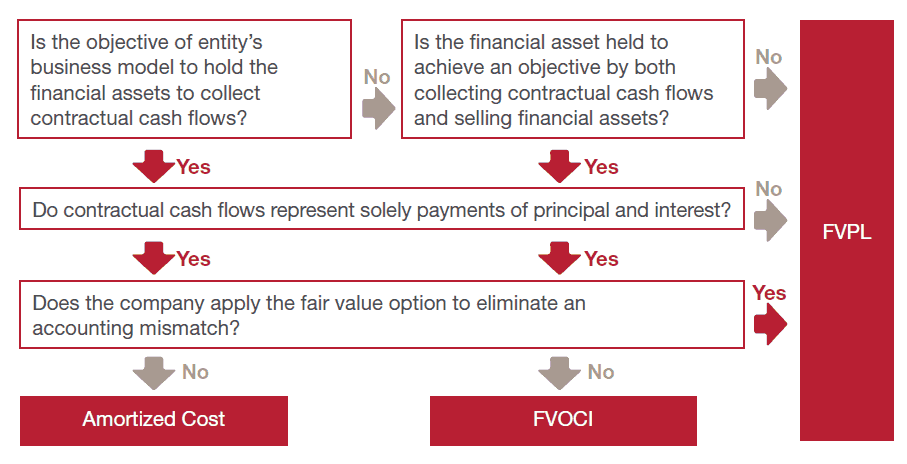

Since equity is the residual interest in the assets of the entity after deducting all of its liabilities a contract that contains neither of the two features would be classified as equity. Conceptual framework Definition of equity and distinction between liabilities and equity instruments Conceptual framework Use of business model Annual improvements 2012-2014 cycle IFRS 7. All equity investments in scope of IFRS 9 are measured at fair value in the statement of financial position with value changes recognised in profit or loss except for those equity investments for which the entity has elected to present value changes in other comprehensive income.

Equity is defined in the Conceptual Framework residual value of assets after deduction of liabilities. The nancial concept of capital is adopted by most entities. Under IAS 32 Financial Instruments.

An unavoidable contractual obligation for an amount independent of the entitys available economic resources amount. Financial liabilities as defined under IAS 32 can be exceptionally classified as equity if they meet certain criteria. Financial assets under IFRS 9 17 At cost At fair value Most simple bonds and most simple loans if held solely to collect the principal and interest All other financial assets not held solely to collect principal and interest most traditional lending businesses investments with complex cash flows all equity investments all derivatives bonds or.

On formation the equity instruments represent 10 of the value of the assets purchased. IFRS 3 capital Under a nancial concept of capital such as invested money or invested purchasing power the net assets or equity of the entity. Basic liabilityequity classification requirements under IFRS.

4 Financial instruments under IFRS Scope The scope of the standards is wide-ranging. The equity instruments are designed to provide first loss protection to the debt investors and receive any residual returns of the investee. Whether an instrument in question meets the definition of a financial liability.

As an exception to the definition of a financial liability an instrument that includes a contractual obligation for the issuing entity to deliver to another entity a pro rata share of its net assets only on liquidation can be classified as equity if it meets the criteria specified in paragraphs IAS 3216C-16D with additional clarifications in paragraphs IAS 32AG29A. International Accounting Standards IAS 1 suggests that shareholders interests be subcategorised into three broad subdivisions. Presentation a financial liability is defined as a contractual obligation to transfer cash or another financial asset.

Definition of equity An equity instrument is defined by IAS 32 as any contract that evidences a residual interest in the assets of an entity after deducting all of its liabilities IAS 3211. On the one hand IFRS 9 eliminates impairment assessment requirements for investments in equity instruments because as indicated above they now can only be measured at FVPL or FVOCI without recycling of fair value changes to profit and loss. Under the equity method on initial recognition the investment in an associate or a joint venture is recognised at cost.

Incremental costs directly attributable to the issue of shares are accounted for as a deduction from consideration received and are recorded in share premium. Within scope Out of scope Debt and equity investments Investments in subsidiaries associates and joint ventures Loans and receivables. Under a physical concept of capital such as operating capability the productive capacity of.

Shareholders equity is comprised of all capital contributed to the entity plus retained earnings. Anything that meets the definition of a financial instrument is covered unless it falls within one of the exemptions. It is also helpful to look at an equity instrument through a reversed definition of a financial liability discussed above ie.

Understanding Ifrs Fundamentals International Financial Reporting Standards By Kalpesh J Mehta 49 10 Http Www Letras Understanding Financial Fundamental

Understanding Ifrs Fundamentals International Financial Reporting Standards By Kalpesh J Mehta 49 10 Http Www Letras Understanding Financial Fundamental

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy Cash Flow Cash Flow Statement Making Cash

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy Cash Flow Cash Flow Statement Making Cash

Factoring Accounting Accounting Financial Management Financial Strategies

Factoring Accounting Accounting Financial Management Financial Strategies

Revaluation Of Fixed Assets Bookkeeping Business Fixed Asset Finance Investing

Revaluation Of Fixed Assets Bookkeeping Business Fixed Asset Finance Investing

Gaap Vs Ifrs What S The Difference Hbs Online

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy Cash Flow Cash Flow Statement Statement

How To Prepare Statement Of Cash Flows In 7 Steps Cpdbox Making Ifrs Easy Cash Flow Cash Flow Statement Statement

Ifrs Financial Statements Template Excel Why Is Ifrs Financial Statements Template Excel So In 2021 Income Statement Statement Template Financial Statement

Ifrs Financial Statements Template Excel Why Is Ifrs Financial Statements Template Excel So In 2021 Income Statement Statement Template Financial Statement

Discontinued Operation As Per Ifrs 5 Meaning And Explanation Accounting Masterclass Meant To Be Master Class Explanation

Discontinued Operation As Per Ifrs 5 Meaning And Explanation Accounting Masterclass Meant To Be Master Class Explanation

Ifrs 17 9 Series Asset Allocation Considerations Insurance Asset Risk

Ifrs 17 9 Series Asset Allocation Considerations Insurance Asset Risk

Ifrs 3 Business Combinations Achieved In Stages Annualreporting Info

Ifrs 3 Business Combinations Achieved In Stages Annualreporting Info

The Important Solely Payments Of Principal And Interest Test For Ifrs 9 Annualreporting Info

The Important Solely Payments Of Principal And Interest Test For Ifrs 9 Annualreporting Info

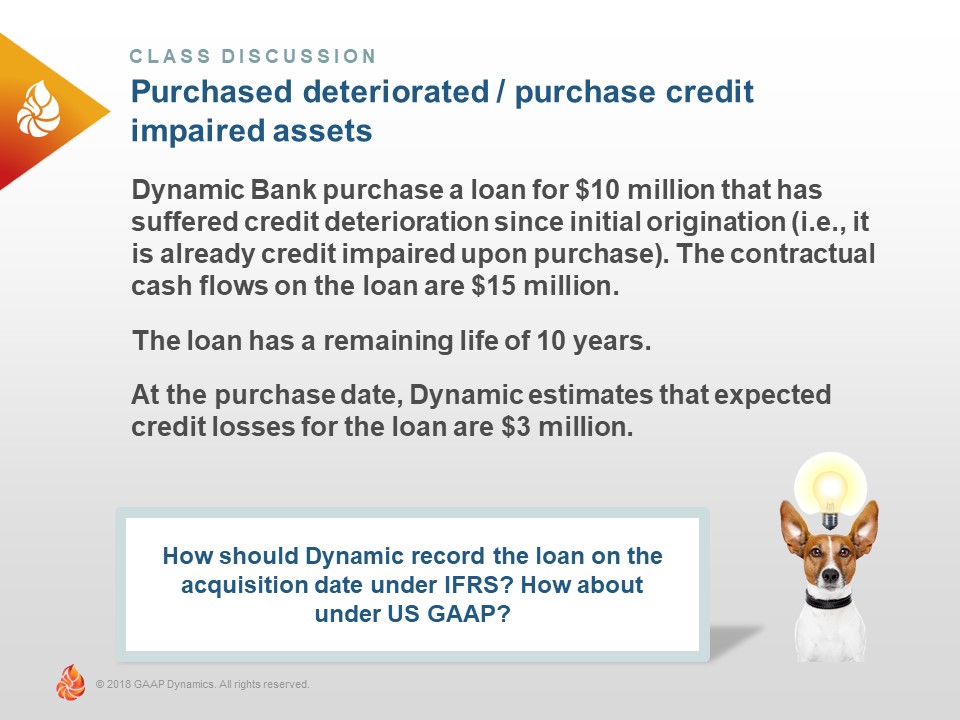

Credit Impaired Differences Between U S Gaap And Ifrs Gaap Dynamics

Credit Impaired Differences Between U S Gaap And Ifrs Gaap Dynamics

Three Statement Model Money Management Advice Cash Flow Statement Learn Accounting

Three Statement Model Money Management Advice Cash Flow Statement Learn Accounting

Ifrs 9 The Sppi Test Explained By Example Annualreporting Info

Ifrs 9 The Sppi Test Explained By Example Annualreporting Info

Elements Of Financial Statements Financial Statement Financial Finance Blog

Elements Of Financial Statements Financial Statement Financial Finance Blog

Equity Cash Flow Statement Financial Statement Balance Sheet

Equity Cash Flow Statement Financial Statement Balance Sheet

Ifrs 15 How To Plan You Know Where Did You Know

Ifrs 15 How To Plan You Know Where Did You Know

Completed Contract Methods Under Ifrs And Gaap Financial Statements Accounting Financial Statement Method Contract

Completed Contract Methods Under Ifrs And Gaap Financial Statements Accounting Financial Statement Method Contract

Post a Comment for "Definition Of Equity Under Ifrs"