Definition Net Present Value Of Zero

Net present value NPV refers to the variance between cash flows over a period of time. NPV accounts for the value of time value of money and cash flows inflows and outflows in a given period of time.

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

The discounted value of an investments cash inflows minus the discounted value of its cash outflows.

Definition net present value of zero. The expected rate of return is below the required rate of return. NPV is used for analyze how profitable an investment or project will be investors or. The project should not be accepted.

Net Present Value vs. This means that the machine will not only pay for itself it will also make 537350. The net present value NPV rule is essentially the golden rule of corporate finance that every business school student is exposed to in most every introductory finance class.

The internal rate of return is a discount rate that makes the net present value NPV of all cash flows equal to zero in a discounted cash flow analysis. More Discounted Cash Flow DCF. If we have more projects to invest in then we can choose the project which has a high net present value.

The net present value rule NPV states that an investment should be accepted if the NPV is greater than zero and it should be rejected otherwise. The NPV Rule states that investing in something that has an NPV greater than zero. The formula is price M 1 i n where.

M maturity value or face value i. It measures the difference between the present value of cash inflows and cash flows for a given time. The project should be accepted.

Conducting financial analysis on zero and negative NPV investments is as important as doing it on positive NPV investments. The general rule of thumb is that if the net present value of an investment or capital purchase is greater or equal to zero it is a good investment. The present value of an annuity is the current value of future payments from that annuity given a specified rate of return or discount rate.

To be adequately profitable an investment should have a net present value greater than zero. Net Present Value NPV is the difference between the present value of cash inflows and the present value of cash outflows over a period of time. For investment in securities the initial cost is usually the only outflow.

IRR calculations rely on the same formula. The basic method for calculating a zero coupon bonds price is a simplification of the present value PV formula. This enables investors to compare two or more unique investments over various time periods and evaluate their profit potential.

The NPV rule dictates that investments. When Projects Have a Zero or Negative NPV. If the net present value is more significant than zero then we can invest in that project and if the net present value is less than zero then we should better not invest in that project.

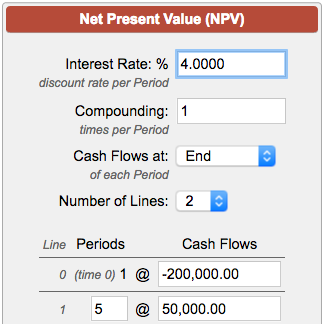

NPV PV Inflows PV Outflows Dont forget that inflows and outflows have opposite signs. Internal Rate of Return IRR Internal rate of return IRR is very similar to NPV except that the discount rate is the rate that reduces the NPV of an investment to zero. NPV takes into account the difference over time.

As you can see the net present value of this machine is 537350. Both a and c. The Net Present Value Rule or NPV Rule is a simple rule that helps companies and investors decide whether they should take on an investment or not.

The net present value NPV is simply the sum of the present values PVs and all the outflows and inflows. If the net present value for a project is zero or positive this means a. The formula for determining the net present value is.

While both look at the profitability of an investment the internal rate of return is calculated so that the net present value is always zero. Also recall that PV is found by the formula PV FV 1i.

Relationships Between Irr Cost Of Capital And Npv

Relationships Between Irr Cost Of Capital And Npv

What Is Npv And How Does It Work

What Is Npv And How Does It Work

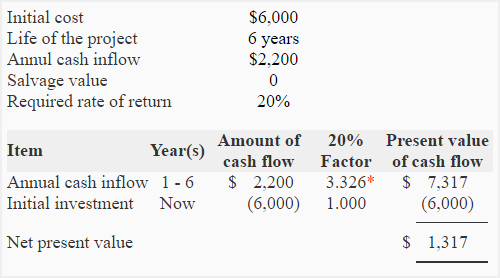

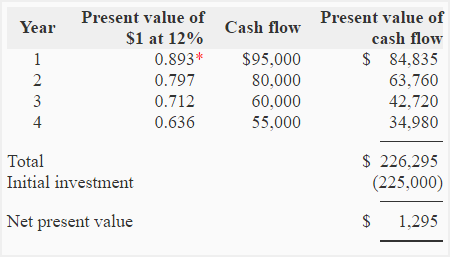

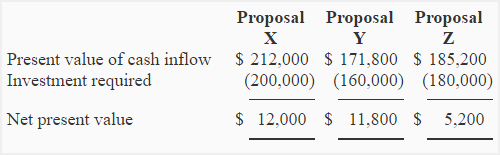

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

What Is Npv And How Does It Work

What Is Npv And How Does It Work

Npv Vs Irr Overview Similarities And Differences Conflicts

Npv Vs Irr Overview Similarities And Differences Conflicts

:max_bytes(150000):strip_icc()/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg) What Is The Formula For Calculating Net Present Value Npv In Excel

What Is The Formula For Calculating Net Present Value Npv In Excel

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg) Net Present Value Npv Definition

Net Present Value Npv Definition

/dotdash_Final_Formula_to_Calculate_Net_Present_Value_NPV_in_Excel_Sep_2020-01-1b6951a2fce7442ebb91556e67e8daab.jpg) What Is The Formula For Calculating Net Present Value Npv In Excel

What Is The Formula For Calculating Net Present Value Npv In Excel

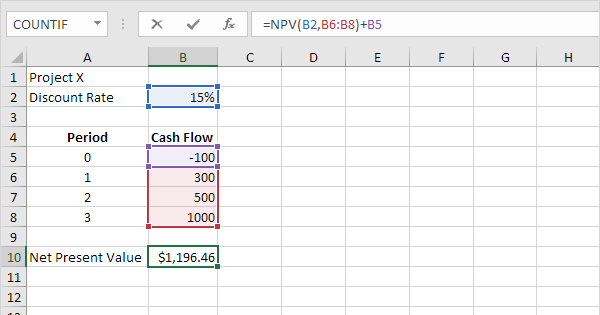

Npv Formula In Excel Easy Excel Tutorial

Npv Formula In Excel Easy Excel Tutorial

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

What Is The Formula For Calculating Net Present Value Npv In Excel

What Is Npv And How Does It Work

What Is Npv And How Does It Work

/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg) Net Present Value Npv Definition

Net Present Value Npv Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Net_Present_Value_NPV_Jul_2020-01-4cf181815e2741debb4174301e1b4b99.jpg) Net Present Value Npv Definition

Net Present Value Npv Definition

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

Net Present Value Npv Method Explanation Example Assumptions Advantages Disadvantages Accounting For Management

What Is The Formula For Calculating Net Present Value Npv In Excel

Post a Comment for "Definition Net Present Value Of Zero"